In the highly competitive world of tax services, finding new clients can feel like a constant uphill battle—especially during tax season when every firm is fighting for attention. But what if your happiest clients and trusted partners could become your best marketing team? That’s exactly what a referral program can do for your tax service business.

Referral programs are one of the most effective ways to attract high-quality clients while keeping marketing costs low. With the right strategy, you can build a system that rewards your clients for spreading the word, while keeping your pipeline full year-round.

Let’s explore how to create a referral program tailored for tax preparers, accounting firms, and CPAs—one that not only brings in new clients but strengthens your existing client relationships.

Referral programs are one of the most effective ways to attract high-quality clients while keeping marketing costs low. With the right strategy, you can build a system that rewards your clients for spreading the word, while keeping your pipeline full year-round.

Let’s explore how to create a referral program tailored for tax preparers, accounting firms, and CPAs—one that not only brings in new clients but strengthens your existing client relationships.

Why Every Tax Service Needs a Referral Program

1. Trust is Everything

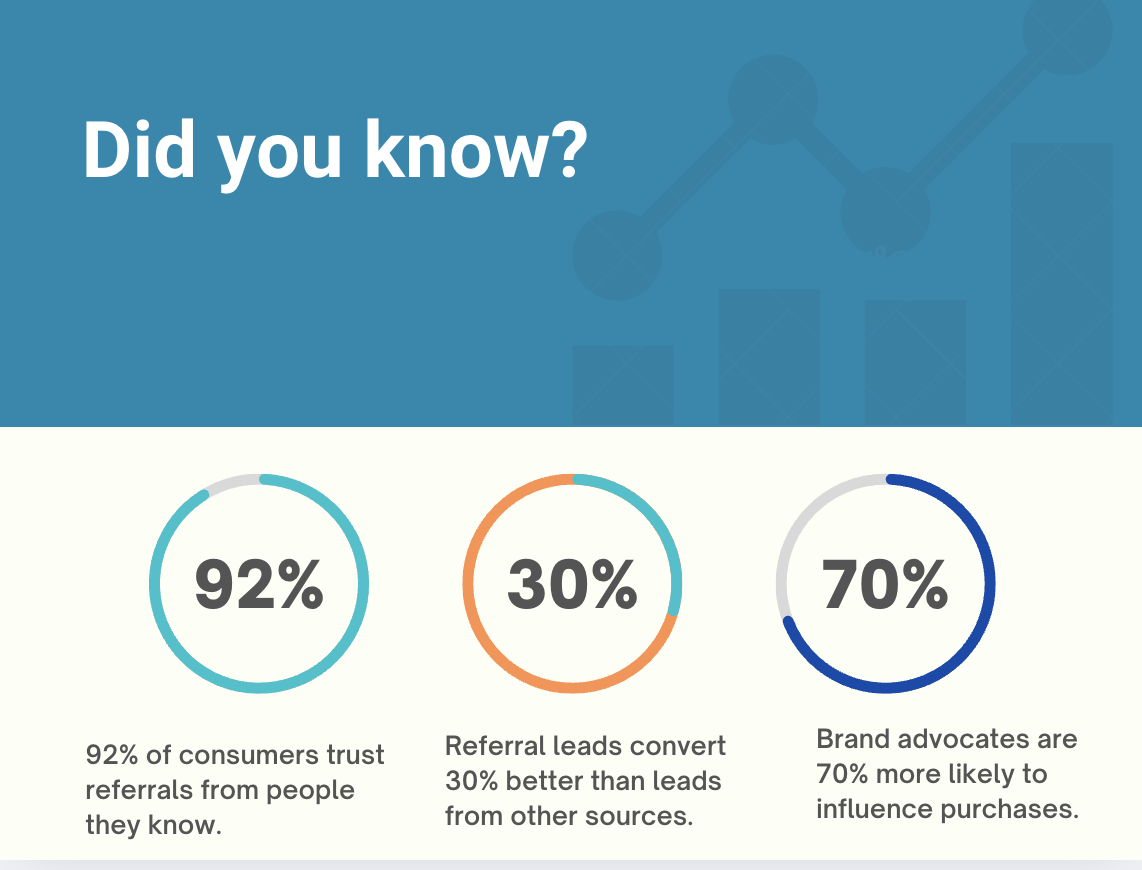

Over 92% of consumers trust referrals from people they know, making personal recommendations one of the most credible forms of marketing. For tax and financial services, this trust factor is even more critical (Source: Nielsen).

2. Lower Acquisition Costs

Referred customers are cheaper to acquire compared to leads from paid channels and often have higher lifetime value (Source: Harvard Business Review).

3. Higher Conversion Rates

Referral leads convert 30% better than leads from other sources (Source: McKinsey & Company).

4. Clients Become Advocates

Clients who refer others are more loyal, with higher retention rates compared to non-referring clients (Source: Deloitte).

Essential Ingredients for a High-Performing Tax Service Referral Program

1. Set Clear Goals

Before you build your program, get clear on what success looks like. Consider goals like:

- Total new clients from referrals

- Revenue from referred clients

- Retention rates for referred clients

- Number of referral partnerships established with complementary professionals (like financial advisors or attorneys)

2. Offer Rewards That Matter

To motivate referrals, your rewards must feel valuable. Popular options for tax services include:

- Cash Rewards: A flat fee per successful referral.

- Discounted Services: Offer the referrer and the new client discounts on future filings.

- Exclusive Perks: Gift cards, VIP service, or free consultations.

- Tiered Rewards: Higher rewards for top referrers.

💡 Studies show that businesses offering dual-sided rewards (where both the referrer and the referred client receive incentives) experience significantly higher referral participation and conversion rates (Source: Harvard Business Review - The Psychology of Reciprocity).

3. Make Referrals Seamless

If your referral process is confusing, clients won’t participate. A streamlined process with personal referral links, clear tracking, and timely rewards encourages participation (Source: HubSpot).

Promote Your Tax Service Referral Program Like a Pro

- Website Promotion: Place banners and CTAs on key pages.

- Email Marketing: Announce and remind clients about your program in newsletters.

- Social Media Campaigns: Encourage sharing through social platforms.

- Team Involvement: Train staff to mention your referral program during client meetings.

💡 Businesses that actively promote their referral programs across channels see significantly higher engagement rates (Source: American Marketing Association - AMA).

Don’t rely solely on clients—tax service businesses can build partner referral programs with:

Professional referral partnerships are particularly effective in financial services, where relationship-driven referrals account for over 70% of new client acquisitions (Source: Hinge Research Institute).

- Financial Advisors

- Mortgage Brokers

- Estate Attorneys

- Insurance Agents

Professional referral partnerships are particularly effective in financial services, where relationship-driven referrals account for over 70% of new client acquisitions (Source: Hinge Research Institute).

Track, Analyze & Optimize for Long-Term Success

Tracking and analytics are critical. Businesses that actively monitor referral performance and adjust rewards or messaging based on data can significantly improve referral rates over time (Source: Harvard Business Review).

Key Metrics to Track

- Referral Sources: Who refers the most?

- Conversion Rates: How many referrals become clients?

- Reward Costs vs. Client Value: Is the program profitable?

- Participation Rates: How many clients and partners engage with your program?

Real-World Examples of Tax Service Referral Success

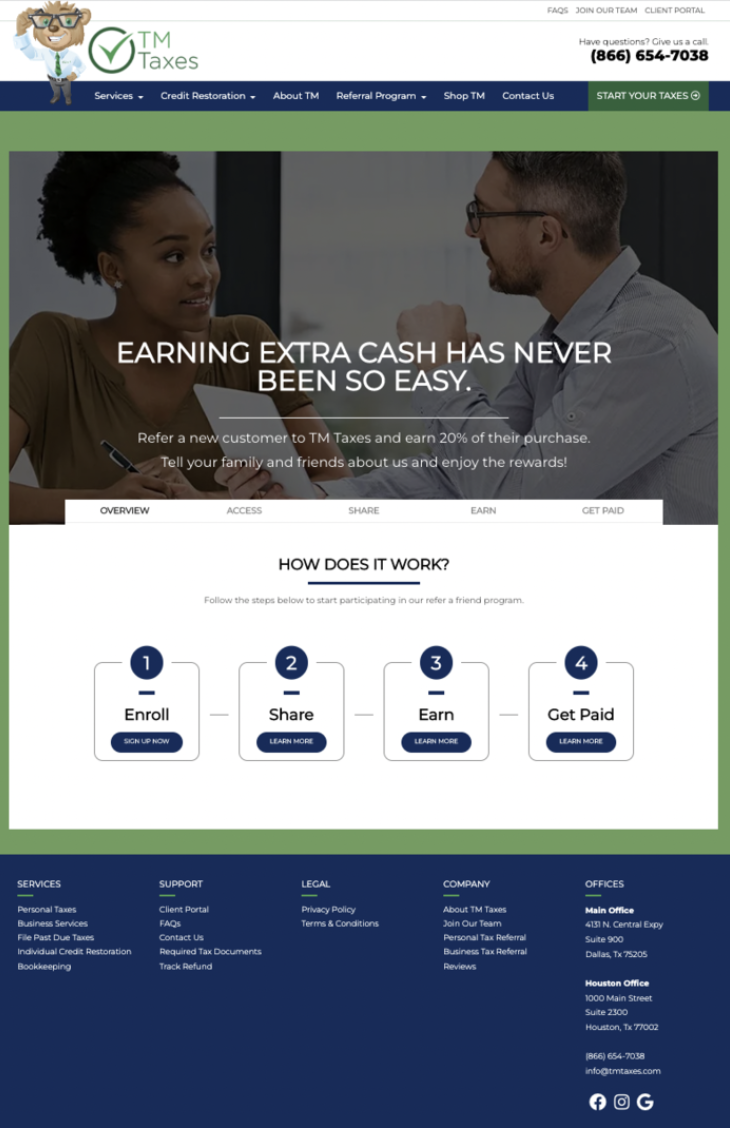

1.TM Taxes’ Successful Referral Campaign

TM Taxes, a regional tax preparation company, launched a "Refer a New Customer & Earn 20%" campaign to drive new business. Using Genius Referrals, they:

💡 Result: TM Taxes experienced a noticeable boost in new client sign-ups during tax season, demonstrating how a well-structured referral program can drive significant growth.

- Offered a 20% commission on each referred customer’s purchase.

- Automated tracking and payouts, ensuring a seamless experience for both referrers and new clients.

- Embedded referral links directly into client portals for easy sharing.

💡 Result: TM Taxes experienced a noticeable boost in new client sign-ups during tax season, demonstrating how a well-structured referral program can drive significant growth.

2.Tax Robot’s Give & Get Campaign

Tax Robot launched a dual-sided referral program where new customers received $200 off their tax services, while the referrer earned $200 in return. By using Genius Referrals, they:

- Seamlessly tracked referrals, automated rewards, and simplified the process for users. This initiative not only increased engagement but also reinforced customer trust and satisfaction.

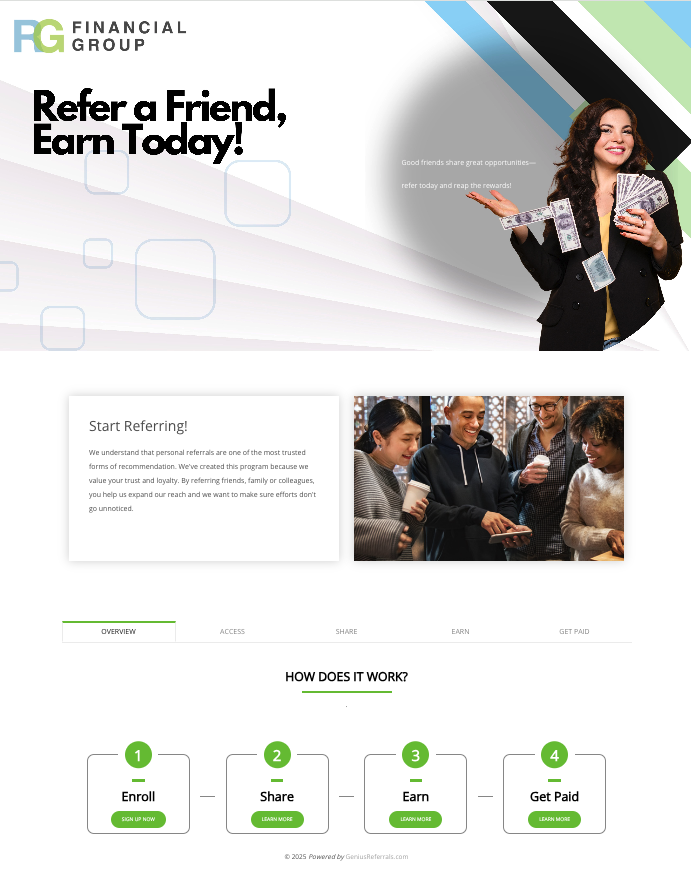

3. How RG Financial Group Boosted Client Acquisition with Genius Referrals

RG Financial Group launched their "1+ Referrals = $50" campaign using Genius Referrals, and the results spoke for themselves. By offering $50 for each successful referral, they saw a significant increase in new clients and referrals from their existing ones.

How Genius Referrals Made It Happen:

With Genius Referrals, RG Financial Group built a successful, scalable program that helped them grow their client base and enhance customer loyalty.

How Genius Referrals Made It Happen:

- Easy Setup: RG Financial Group quickly launched a seamless referral program.

- Increased Engagement: Clients eagerly participated, driving new business.

- Automated Tracking & Payouts: The platform handled everything, ensuring smooth operations.

- Cost-Effective Growth: By focusing on referrals, they reduced acquisition costs.

With Genius Referrals, RG Financial Group built a successful, scalable program that helped them grow their client base and enhance customer loyalty.

Avoid These Common Referral Program Pitfalls

❌ Vague Rewards: Clear incentives drive higher participation.

❌ Complicated Processes: Seamless systems see higher engagement.

❌ Lack of Promotion: Consistent reminders matter.

❌ No Data Tracking: Without insights, optimization is impossible

❌ Complicated Processes: Seamless systems see higher engagement.

❌ Lack of Promotion: Consistent reminders matter.

❌ No Data Tracking: Without insights, optimization is impossible

Scaling Your Referral Program for Long-Term Growth

Once your program is up and running, focus on scaling it for long-term success:

Expand your partner network.

- Offer VIP tiers for high-performing referrers.

- Automate referral tracking and communication.

- Collect and use referrer feedback to improve.

- Recognize and celebrate top referrers.

Conclusion: Turn Client Trust Into Year-Round Growth

A well-executed tax referral program can be a powerful growth engine for your business. By understanding your audience, offering attractive incentives, and promoting your program effectively, you can build a sustainable source of high-quality leads.

With Genius Referrals, you can automate and streamline your referral processes, saving you time, cost, and hassle. Start small, track your results, and optimize as you go. With the right strategy and tools, your tax referral program can become a cornerstone of your growth efforts.

Ready to Launch Your Tax Referral Program?

With Genius Referrals, you can:

✅ Launch and manage your referral program in minutes.

✅ Automate tracking, messaging, and rewards.

✅ Scale from client referrals to an entire partner network.

👉 Start Your Free Trial and Build Your Tax Referral Program Today!

✅ Launch and manage your referral program in minutes.

✅ Automate tracking, messaging, and rewards.

✅ Scale from client referrals to an entire partner network.

👉 Start Your Free Trial and Build Your Tax Referral Program Today!